The Marion Chronicle-Tribune continues to perform investigative journalism virtually every other major newspaper in Indiana has ceased doing. "Where did the money go?" seems to be a common theme of their reporting of late and for good reason. In 2009, the administration of Mayor Wayne Seybold obtained approval from the town's council to issue up to $2.5 million in tax increment financing ("TIF") bonds to a little-known Korean businessman from Ontario, California, to purchase and redevelop the city's recently-closed YMCA building on Third Street. Five years later, the building sits undeveloped and has been put on the selling block for unpaid taxes. No visible work has been done on the building, and the property generated no bids when it was offered at a tax sale last year. When the Chronicle-Tribune

set out to learn what happened with the money through a public records request, it learned that city officials couldn't account for how at least $2 million of the bond proceeds had been spent.

This saga began when Korean businessman Michael An's Global Investment Consulting, a Nevada corporation, approached city officials in 2009 about redeveloping the vacant YMCA building. An's local business representative was Chad Seybold, brother of Mayor Seybold. An's $6 million redevelopment plan included adding a dry-cleaning business, men's clothing store, women's clothing store, spa, hotel and restaurant to the vacant building after renovations. An told city officials that the project would add between 80 to 90 new jobs with an annual payroll of between $1 to $2 million. Anyone who drove by this location, knew a little about Marion's economic situation and turned on his or her brain for a few minutes would quickly conclude it was a half-baked deal that had no realistic chance of success. Unfortunately, no due diligence was performed before proceeding with the investment of public tax dollars in the project.

An was described to local officials as "a Korean-born investor and retired businessman in California." According to Nevada Secretary of State corporation records, An appears to be the sole shareholder of Global Investment Consulting. An individual by the name of Claude Brock, who serves as a registered agent for multiple businesses, is identified as the company's registered agent. A Google Earth view of the business address for Brock shows a high-rise residential building a few blocks off the Las Vegas strip. A business address in Santa Ana, California is also listed, which appears as a small residential house on Google Earth. The Indiana registered address for Global Investment Consulting according to the Secretary of State records is the vacant YMCA building with An listed as the registered agent at that address. That foreign registration occurred the same month that Marion's common council approved the issuance of $2.5 million in TIF bonds for the project. Global Investment Consulting's business address is listed in its Indiana filing as a post office box in Cucamonga, California.

Further research reveals that Global Investment Consulting is listed as one of the few regional centers in Indiana certified for the controversial foreign immigrant immigrant visa program known as EB-5, although it doesn't appear to have operated as a regional center. Under this immigrant visa program, foreign investors can get a green card for investing at least $1 million in a qualified American investment, or $500,000 if the business investment is made in an area that qualifies as a depressed economic area.

The EB-5 program's

controversy was raised in a December 15, 2012 investigative series by the Indianapolis Star titled, "

The China Letter." The investigative series focused on Monica Liang and her controversial role as a former consultant to Mayor Seybold and the Indiana Economic Development Corporation's former executive director, Mitch Roob. Liang, a Chinese immigrant, had defrauded a Chinese billionaire out of $50,000, which she represented to the billionaire was part of a plan to invest in a building that she owned in downtown Marion that was to be redeveloped as a nursing home for veterans.

According to the Star, Liang had misrepresented to Ao Yuqi, the Chinese billionaire, that Gov. Mitch Daniels, Mayor Seybold and Mitch Roob were shareholders in the company that planned to redevelop her building. Ao had expected to obtain a green card as part of his investment in the project as an EB-5 investor. Liang, who was in her early 40s, later died under bizarre circumstances after going into cardiac arrest while a Chicago attorney,

Thomas Gehl, who was advising her on the EB-5 program, was visiting her at her apartment in Carmel a short time after Roob had fired her as a consultant to the IEDC after learning of her misrepresentations and fraud and had stepped down as head of the state agency. Roob denied to the Star that he had a sexual relationship with Liang, who had traveled on trips to China with Gov. Daniels and Mayor Seybold as part of larger trade delegation to Asia. It is unclear what, if any, role Liang may have had in introducing Michael An's investment to Marion city officials, although it would have been consistent with her economic development activities with the city during that time period.

An's Global Investment Consulting entered into a loan agreement with Marion for $2.5 million as part of the redevelopment plan for the YMCA building he acquired in February, 2009 in which the city agreed to take out the $2.5 million bond "for financing the construction of the project to create

additional employment opportunities in Marion, Indiana, and to benefit the

health, safety, morals and general welfare of the citizens of Marion and the

state of Indiana." The bond indenture and related loan agreements were prepared by Barnes & Thornburg's Bruce Donaldson, while London Whitte's Bob Swintz acted as the city's financial adviser on the transaction. First Farmers Bank & Trust, which held a $5 million mortgage on the YMCA building, acted as trustee. Repayment of the bonds were to be paid out of TIF revenues generated by Global Investment Consulting's redevelopment project. Obviously, no revenues have been generated by the now-defunct project to pay debt service on the bond issue. According to the Chronicle-Tribune, the city refinanced the outstanding bond obligation less than two years later in February, 2011 as part of a new $5.8 million bond issue. Swintz told the Chronicle-Tribune that the refinancing was undertaken to get a lower interest rate. The bonds are not scheduled to be paid off until 2021.

Shockingly, Marion city officials were unable to produce bank statements, receipts, vendor invoices, or check or wire transfer records to account for how more than $2 million in bond proceeds were spent for An's project. Mayor Seybold, who is a Republican candidate for State Treasurer this year, refused to comment on the missing documentation according to the Chronicle-Tribune. Naturally, An was nowhere to be found. The city's development director, Lisa Dominisse, produced just 16 pages of records in response to the newspaper's request. The documents were primarily invoices from business entities tied to the redevelopment project. Half of the 16 pages, according to the newspaper, pertained to expenses related to renovation and construction of the former YMCA building. "Three Global Investment Consulting invoices from 2009 and 2010 list purchases or services like 'roofing' and 'brick work,' but none was accompanied by supporting documents like receipts for the purchases or vendor invoices for the services," the Chronicle-Tribune reported.

Together, the

invoices contain 27 line items. Five line items, totaling $98,033, are listed

under “Michael An,” the CEO of Global Investment Consulting: “building

purchase” ($54,754), “architectural drawings” ($15,000), “attorney fee”

($20,120), “accountant fee” ($6,000) and “water removal cost — basement — new

sump pump” ($2,159).

The other 22 line

items, totaling more than $1.9 million, are listed under “World Enterprise

Group Inc.” with a federal tax identification number next to the company name.

These line items include the “roofing” and “brick work” as well as “elevator,”

“HVAC” and “plumbing,” for example.

World Enterprise

Group was created by An, who is also listed as the company’s president, on May

6, 2010, according to state corporation records.

The city’s

record-keeping has repeatedly been cited in annual state audits. Concerns noted

in multiple years’ audits include omission of entire city hall departments from

annual financial reports, transfer of funds without city council approval and

inconsistent bank balance reconciliations.

After Gallaway

deferred questions about bond financial records to the bond trustee at the

bank, First Farmers Bank & Trust Vice President Tade Powell referred

questions to the bank’s general counsel, Stephen Wilson.

Wilson confirmed the

bank’s role as trustee, essentially meaning the bank was hired by Marion to

hold and disburse the bond proceeds.

“The bond proceeds

were deposited into an account held and maintained by the Trust Department of

First Farmers Bank & Trust, and these bond proceeds subsequently were

disbursed by the Trust Department in payment of (i) the costs of the issuance

of these bonds, and (ii) costs of the of renovating the former YMCA building in

the City of Marion, including site development,” Wilson said by email.

Wilson did not

respond to follow-up questions about the lack of records like bank statements

for the account that held the loan proceeds.

The Chronicle-Tribune also detailed bond proceeds paid out to the bond lawyers and financial advisers for the transaction:

• $35,000 went to

national law and lobbying firm Barnes & Thornburg, which served as bond

counsel;

• $25,000 went to

Indianapolis-based financial firm London Witte Group, which served as financial

adviser;

• $10,000

Marion-based law firm Kiley Harker Certain, whose partner Thomas R. Hunt served

as counsel for Marion’s Economic Development Commission;

• $10,000 went to

Marion-based law firm Spitzer Herriman Stephenson Holderead Musser and Conner,

whose lawyer Herb Spitzer served as counsel for Marion;

• $2,500 went to First Farmers Bank & Trust

Wealth Management, which served as trustee; and

• $25,000 was kept by First Farmers

Bank & Trust, which bought the bond.

Advance Indiana uncovered another 200 pages of documents online related to the original bond issue, which can be accessed by clicking

here.

The Chronicle-Tribune has blasted Seybold's management of the city's finances at length in recent editorials. A recent editorial accused Seybold of "aggressively spreading untruths about public matters that will affect the city for decades," including a claimed $2 million surplus in the city's budget. According to the editors, the surplus was only made possible because Seybold chose not to pay back the amount due on a $1.7 million loan to the water utility, which was originally scheduled to be repaid in 2012, and delayed payment of other bills "until next year and beyond." The editors insist that Marion's financial situation has been propped up by piling up more debt to be paid off by future generations. The newspaper attacked Seybold for spending $7,000 in public funds to tout a surplus it claims truly doesn't exist.

One of the running feuds Seybold has with the editors of the Chronicle-Tribune is over the categorization of TIF-related debt. Seybold insists that it's not really city debt because repayment of the debt relies on property tax revenues generated by TIF economic development projects. The developers are the one's repaying the debt he argues; however, when the projects fail as has happened frequently in Marion and elsewhere around the state, the taxpayers are left holding the bag. As the Chronicle-Tribune's editors say, "That is a distinction without a difference." The editors point out that the city has been forced to redirect money generated by other projects within TIF districts to repay all of the projects like An's that failed to pan out.

The Chronicle-Tribune's Karla Bowsher has taken Seybold to task for doling out city contracts to the same people who are backing his campaign for State Treasurer, including Barnes & Thornburg's Bob Grand, who co-chairs his committee with Lake County attorney Dan Dumezich, and Jim Higgins, a partner at London Witte.

London Witte Group has served as financial adviser to the Seybold administration on general matters and particularly on bond transactions since at least 2005, making in the neighborhood of at least $25,000 to $30,000 per transaction, records shows. Barnes & Thornburg has served as bond counsel since at least 2005, making in the neighborhood of $35,000 to $50,000 per transaction.

Seybold pointed out that he has also worked with other firms on such matters during his three terms as mayor, although he has for years regularly used London Witte Group and Barnes & Thornburg for bond transactions.

"You're barking up the wrong tree. I don't make decisions of that kind," Seybold said. I try to hire really good people.

Grand agreed with Seybold ’s hiring of Barnes & Thornburg.

"He did the best thing for the city because be got the best firm for the city, he said. "Our qualifications we could put up against anybody."

Barnes & Thornburg partner Brian Burdick, named on Seybold's campaign letterhead, is general counsel for the Indiana Bond Bank, according to the firm's website.

The Indiana Bond Bank is one of the boards that the state treasurer chairs in addition to his duties as the state's chief investment officer. Of the 13 boards the treasurer sits on, the Indiana Bond Bank may be the busiest, said Ball State University political science professor Ray Scheele, because so many local governments are authorized to raise money via bonds.

The Indiana Bond Bank helps local governments secure various types low-cost financing. According to the 2013 annual report of the current state treasurer, Richard Mourdock, the bond bank issued about $517 million in debt on half of local governments during the 2013 fiscal year . . .

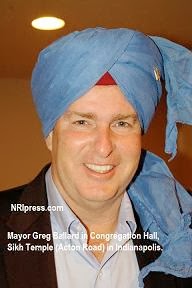

It's unfortunate that you won't see this kind of reporting in the Indianapolis Star. Previously, this blog built on original reporting by the Chronicle-Tribune on how state and Marion city officials

invested tens of millions of our tax dollars in a company founded and controlled by a California businessman who defrauded more than 500 investors out of $160 million through a Ponzi scheme remarkably similar to the one perpetrated by Indianapolis businessman Tim Durham. The public in Indianapolis doesn't have a clue about what's happening with the hundreds of millions of dollars that have been borrowed and invested in TIF projects, virtually all of which benefit developers that have contributed heavily to Mayor Greg Ballard's and other local politicians' campaign committees. The City of Indianapolis is paying huge fees to the same bond lawyers and financial advisers upon which the City of Marion is relying. We've demonstrated time and time again that city finances are being dictated by those same players. The Indiana State Treasurer's Office is similarly controlled by these same people and apparently will continue to be if these self-serving people get their way. Meanwhile, the taxpayers always wind up getting stuck with the bill for the bad deals this corrupt bunch of actors concoct on behalf of public officials whose decision-making is obviously blinded by the campaign support they receive from them.